Asset Allocations

Portfolio holdings are subject to change, vary over time and should not be considered a recommendation to buy any individual security.

Back to TopMonthly Breakdown

Historical Breakdown

Holdings

Portfolio holdings are subject to change, vary over time and should not be considered a recommendation to buy any individual security.

Back to Top

Performance through Jul 1, 2024

Annual Return through Jun 30, 2024

Total Annual Operating Expenses are 1.84%, Total Annual Fund Operating Expenses after Fee Waiver and Reimbursement are 1.84%; no Sales Charge (commission or “load”) or 12b-1 distribution fee.

The performance presented above is net of the maximum sales charge (“load”) for the respective share class.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 1-866-738-4363 (1-866-RETI-FND).

(1) Represents the percentage increase/decrease in the net asset value from the prior trading day.

(2) Performance for periods of less than one year is not annualized.

(3) The inception date of the Sierra Tactical Municipal Fund is December 26, 2018.

Record Date: The date the distribution amount is declared.

Ex-Date / Pay Date: The date the distribution is paid to investors.

Top ResourcesView all resources

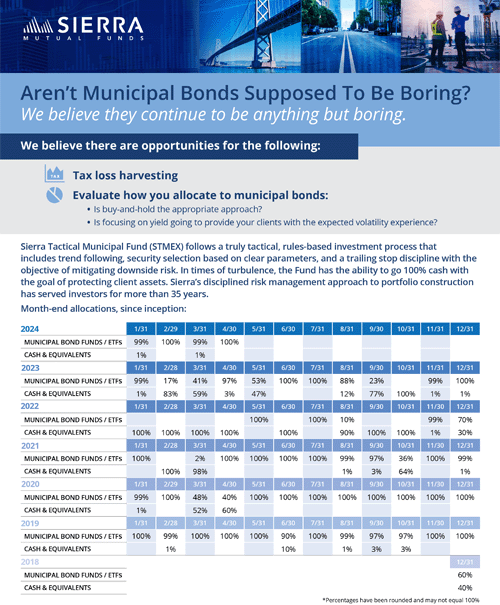

Municipal Bonds are Anything but Boring

Municipal bonds are supposed to be boring, but they’ve been anything but boring in 2023. The environment has created an opportunity for tax harvesting and for evaluating how you allocate to municipal bonds.

Sierra Tactical Municipal Fund: Performance Snapshot

Monthly performance analysis booklet for the Sierra Tactical Municipal Fund sourced through Morningstar, updated through May 31, 2024

Navigate Through Our Solutions

An all-in-one brochure that covers our core beliefs, investment process, funds, and strategies.

| Sierra Tactical Municipal Fund Summary Prospectus (January 29, 2024) | Download |

|---|---|

| Sierra Tactical Municipal Fund Prospectus (January 29, 2024) | Download |

| Sierra Mutual Funds Statement of Additional Information (January 29, 2024) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (December 31, 2023) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (June 30, 2023) | Download |

| Sierra Mutual Funds Semi-Annual Report (March 31, 2024) | Download |

| Sierra Mutual Funds Annual Report (September 30, 2023) | Download |

Asset Fact Sheets

| Sierra Tactical Municipal Fund - Instl Class - Fact Sheet | Download |

|---|---|

| Sierra Tactical Municipal Fund - Class A & C - Fact Sheet | Download |

Asset Fund Documents

| Sierra Tactical Municipal Fund Summary Prospectus (January 29, 2024) | Download |

|---|---|

| Sierra Tactical Municipal Fund Prospectus (January 29, 2024) | Download |

| Sierra Mutual Funds Statement of Additional Information (January 29, 2024) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (December 31, 2023) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (June 30, 2023) | Download |

| Sierra Mutual Funds Semi-Annual Report (March 31, 2024) | Download |

| Sierra Mutual Funds Annual Report (September 30, 2023) | Download |

Overview

Back to TopInvestment Objectives

The Fund seeks total return, including tax-free income from the dividends of underlying municipal bond funds, while seeking to limit volatility and downside risk.

The interest income from muni bonds is tax-free at the federal level, a valuable benefit that is passed on to shareholders as to the monthly dividends from the Fund.

The Portfolio Managers typically diversify the Fund among ten or more underlying muni bond mutual funds and/or ETFs, and each holding is monitored daily. The Fund will typically be fully invested when the muni market is in a rising trend. During price declines in the muni bond market a proprietary stop-loss discipline is implemented, with the goal of limiting drawdowns in the price of the Fund. During such episodes, the Fund may be partly or fully in a tax-free money market fund until the muni bond market turns up again.

Managers seek to outperform the Bloomberg Barclays Municipal Bond Index.