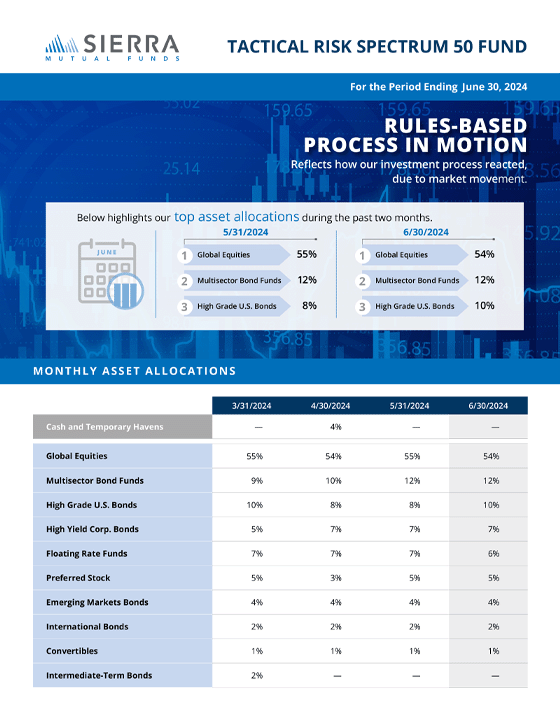

Asset Allocations

Portfolio holdings are subject to change, vary over time and should not be considered a recommendation to buy any individual security.

Back to TopMonthly Breakdown

Historical Breakdown

Holdings

Portfolio holdings are subject to change, vary over time and should not be considered a recommendation to buy an individual security.

Back to Top

Performance through Jul 26, 2024

Annual Return through Jun 30, 2024

Total Annual Operating Expenses are 1.62%.

The performance presented above is net of the maximum sales charge (“load”) for the respective share class.

The performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted above. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that investor’s shares, when redeemed, may be worth more or less than their original cost. For performance information current to the most recent month-end, please call toll-free 1-866-738-4363 (1-866-RETI-FND).

(1) Represents the percentage increase/decrease in the net asset value from the prior trading day.

(2) Performance for periods of less than one year is not annualized.

(3) The inception date of the Sierra Tactical Risk Spectrum 50 Fund is May 26, 2021.

Record Date: The date the distribution amount is declared.

Ex-Date / Pay Date: The date the distribution is paid to investors.

Top ResourcesView all resources

Rules-Based Process in Motion Snapshot: Sierra Tactical Risk Spectrum 50 Fund

Reflects how our truly tactical rules-based investment process reacted due to market movement in the Sierra Tactical Risk Spectrum 50 Fund through June 30, 2024.

Sierra Tactical Risk Spectrum Fund Series

Sierra's Tactical Risk Spectrum Fund Series is a suite of multi-asset funds targeting three distinct investor risk profiles.

Navigate Through Our Solutions

An all-in-one brochure that covers our core beliefs, investment process, funds, and strategies.

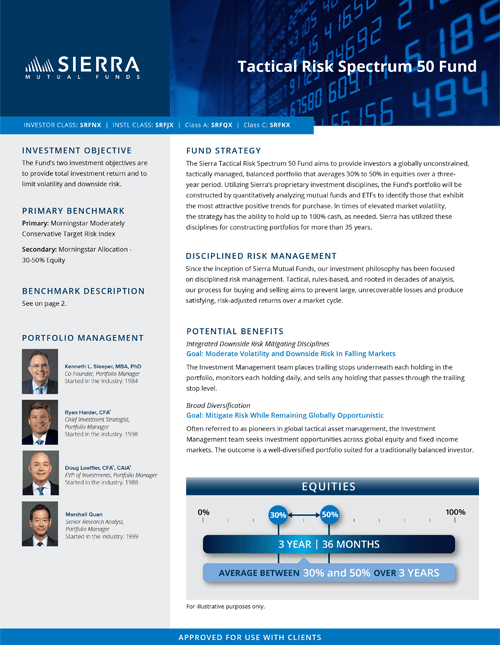

Sierra Tactical Risk Spectrum 50 Fund Profile Sheet

The two investment objectives of the Sierra Tactical Risk Spectrum 50 Fund are to provide total investment return and to limit volatility and downside risk.

| Sierra Tactical Risk Spectrum 50 Fund Summary Prospectus (2024 R1) | Download |

|---|---|

| Sierra Tactical Risk Spectrum 50 Fund Prospectus (2024 R1) | Download |

| Sierra Mutual Funds Statement of Additional Information (January 29, 2024) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (December 31, 2023) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (June 30, 2023) | Download |

| Sierra Mutual Funds Semi-Annual Report (March 31, 2024) | Download |

| Sierra Mutual Funds Annual Report (September 30, 2023) | Download |

Asset Fact Sheets

| Sierra Tactical Risk Spectrum 50 Fund - Instl Class - Fact Sheet | Download |

|---|---|

| Sierra Tactical Risk Spectrum 50 Fund - Class A & C - Fact Sheet | Download |

Asset Fund Documents

| Sierra Tactical Risk Spectrum 50 Fund Summary Prospectus (2024 R1) | Download |

|---|---|

| Sierra Tactical Risk Spectrum 50 Fund Prospectus (2024 R1) | Download |

| Sierra Mutual Funds Statement of Additional Information (January 29, 2024) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (December 31, 2023) | Download |

| Sierra Mutual Funds Quarterly Holdings Report (June 30, 2023) | Download |

| Sierra Mutual Funds Semi-Annual Report (March 31, 2024) | Download |

| Sierra Mutual Funds Annual Report (September 30, 2023) | Download |

Overview

Back to TopInvestment Objectives

The Fund’s two investment objectives are to provide total return (the combination of yield and net price gains from the underlying funds) and to limit volatility and downside risk.

The Sierra Tactical Risk Spectrum 50 Fund aims to provide investors a globally unconstrained, tactically managed, balanced portfolio that averages 30% to 50% in equities over a three-year period. Utilizing Sierra’s proprietary investment disciplines, the Fund’s portfolio will be constructed by quantitatively analyzing mutual funds and ETFs to identify those that exhibit the most attractive positive trends for purchase. In times of elevated market volatility, the strategy has the ability to hold up to 100% cash, as needed. Sierra has utilized these disciplines for constructing portfolios for more than 30 years.