Resources

Our relationship with you is built on trust and transparency. With an aim of keeping you thoroughly informed, we offer valuable information about our funds and more, below. Access our fact sheets, prospectuses, performance reports, and materials for use with clients.

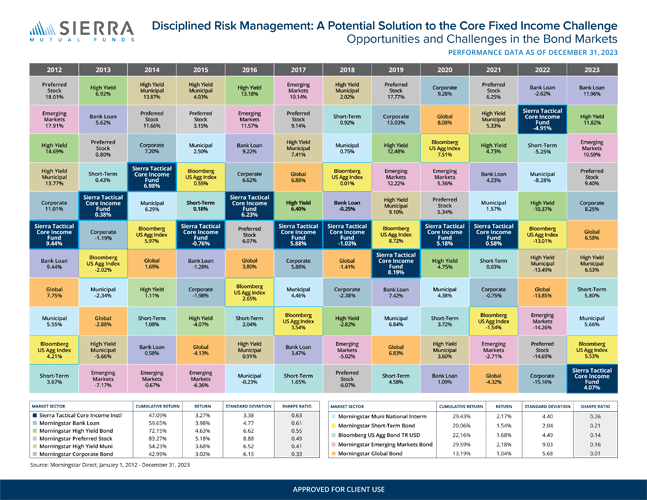

Sierra Tactical Core Income Fund Performance vs. Fixed Income Sectors Ending December 31, 2023

A visual view of the Sierra Tactical Core Income Fund performance against fixed income sectors from 2012 to 2023.

Sierra All Funds Performance Snapshot

Monthly performance analysis booklet for all Sierra Mutual Funds sourced through Morningstar, updated through June 30, 2024.

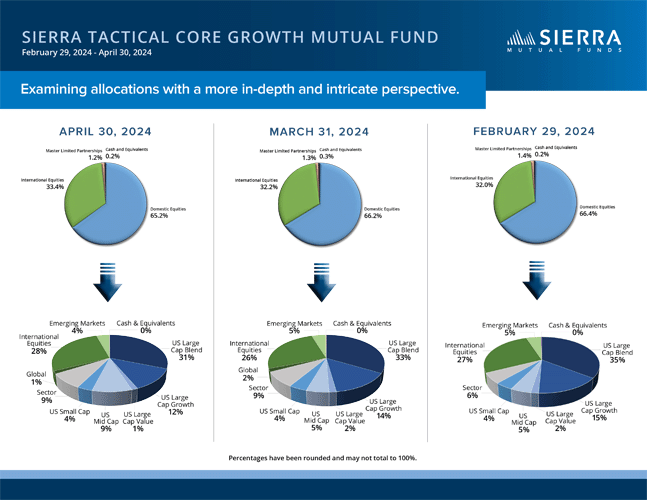

Sierra Tactical Core Growth Fund Allocations Month-over-Month

Details the changes in asset allocations for Sierra Tactical Core Growth from April 2024 to June 2024.

Rules-Based Investment Process in Motion Synopsis: Funds Through June 30, 2024

Reflects how our truly tactical, rules-based investment process reacted with regard to the Sierra Mutual Funds due to market movement over the past 18 months up through June 30, 2024.

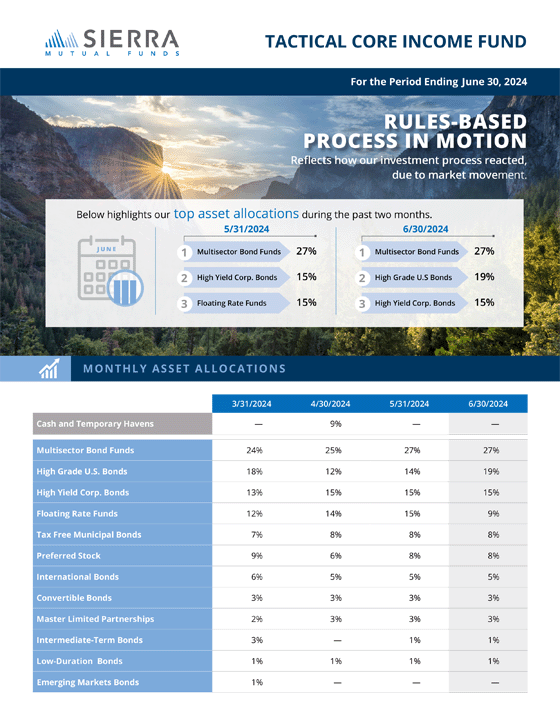

Rules-Based Process in Motion Snapshot: Sierra Tactical Core Income Fund

Reflects how our truly tactical rules-based investment process reacted due to market movement in the Sierra Tactical Core Income Fund through June 30, 2024.

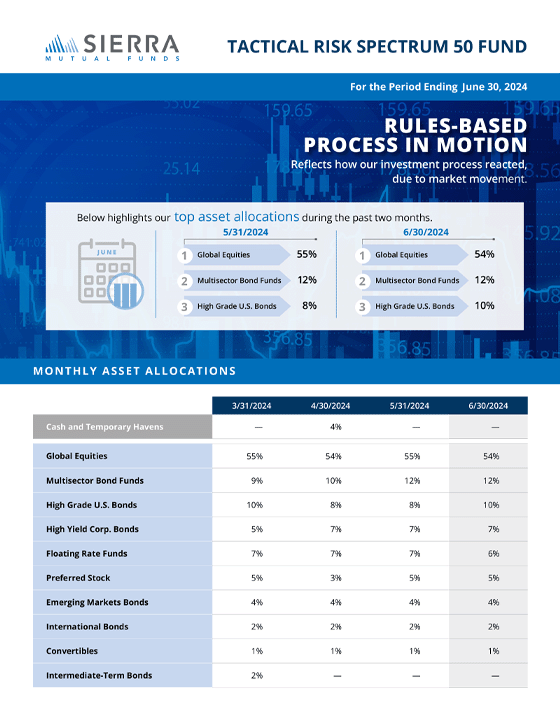

Rules-Based Process in Motion Snapshot: Sierra Tactical Risk Spectrum 50 Fund

Reflects how our truly tactical rules-based investment process reacted due to market movement in the Sierra Tactical Risk Spectrum 50 Fund through June 30, 2024.

Sierra Tactical Municipal Fund: Performance Snapshot

Monthly performance analysis booklet for the Sierra Tactical Municipal Fund sourced through Morningstar, updated through June 30, 2024.

Sierra Tactical Bond Fund: Performance Snapshot

Monthly performance analysis booklet for the Sierra Tactical Bond Fund sourced through Morningstar, updated through June 30, 2024.

Sierra Tactical Core Income Fund: Performance Snapshot

Monthly performance analysis booklet for Sierra Tactical Core Income Fund sourced through Morningstar. Updated through June 30, 2024

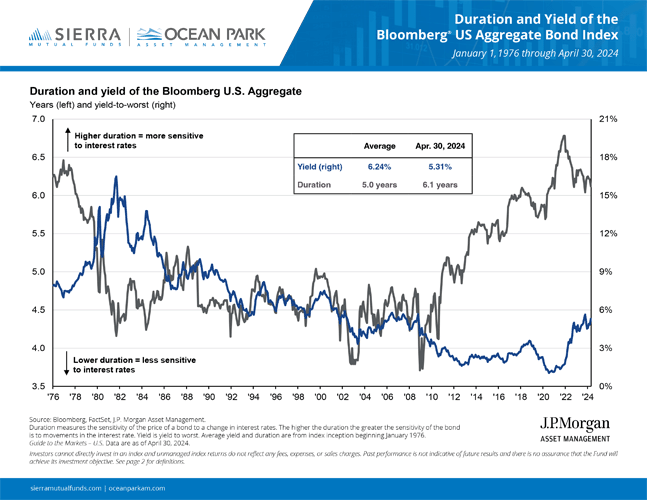

Duration and Yield of the Bloomberg U.S. Aggregate Bond Index

This flyer shows the duration and yield of the Bloomberg U.S. Aggregate Bond Index from January 1977 through May 31, 2024.

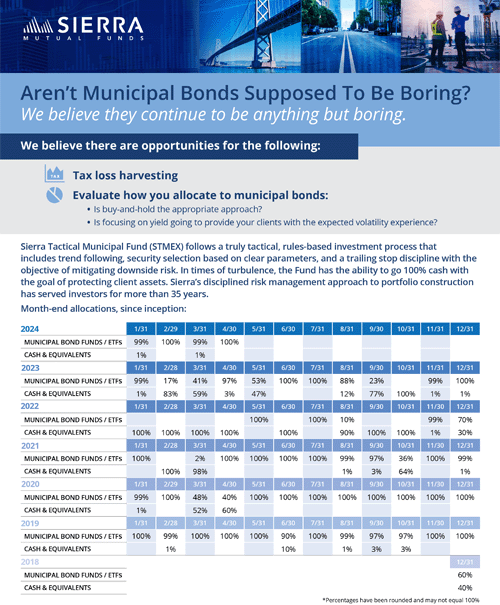

Municipal Bonds are Anything but Boring

Municipal bonds are supposed to be boring, but they’ve been anything but boring in 2023. The environment has created an opportunity for tax harvesting and for evaluating how you allocate to municipal bonds.

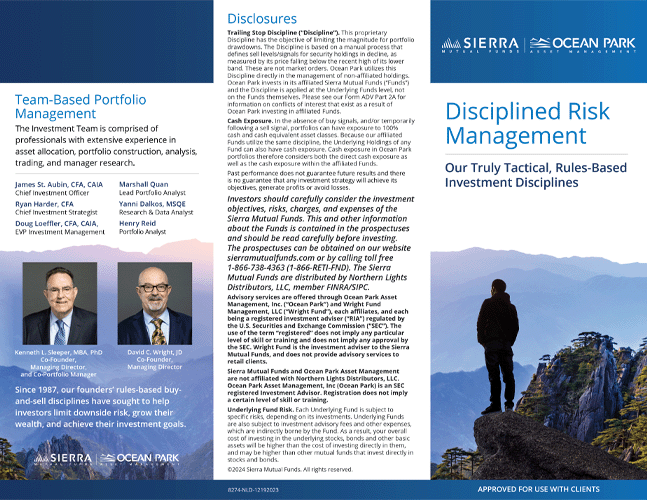

Disciplined Risk Management: Our Investment Process

Our disciplined risk management investment process, including: participating in uptrends, security selection and our trailing stop discipline.

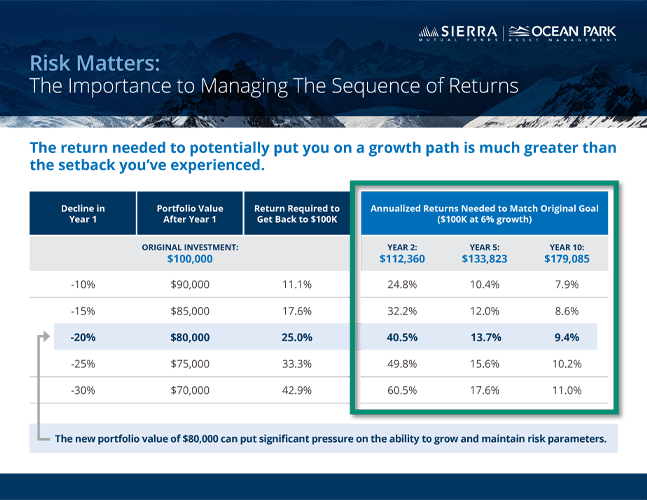

Risk Matters: The Importance to Managing the Sequence of Returns

This flyer shows why it's important to keep losses small, and the gains needed to break even after a market decline over 2, 5, and 10 year periods.

Disciplined Risk Management: Our Investment Process (Tri-fold)

Our disciplined risk management investment process, including: participating in uptrends, security selection and our trailing stop discipline.

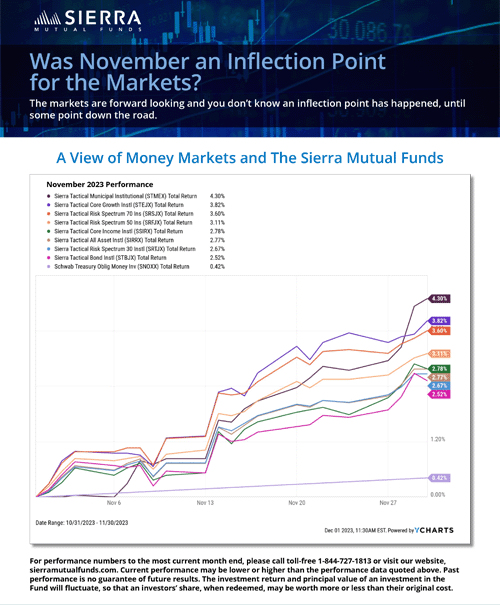

Was November an Inflection Point for the Markets?

Provides a snapshot view of how money markets and the Sierra Mutual Funds performed in November 2023.

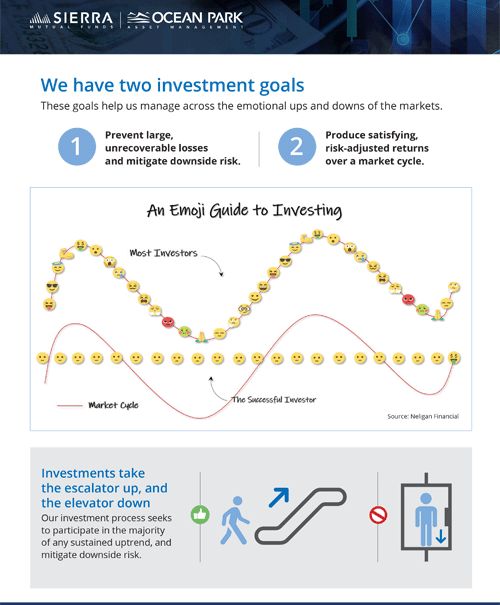

Emotions of Investing

Investments take the escalator up, and the elevator down. Our investment process seeks to participate in the majority of any sustained uptrend, and mitigate downside risk.

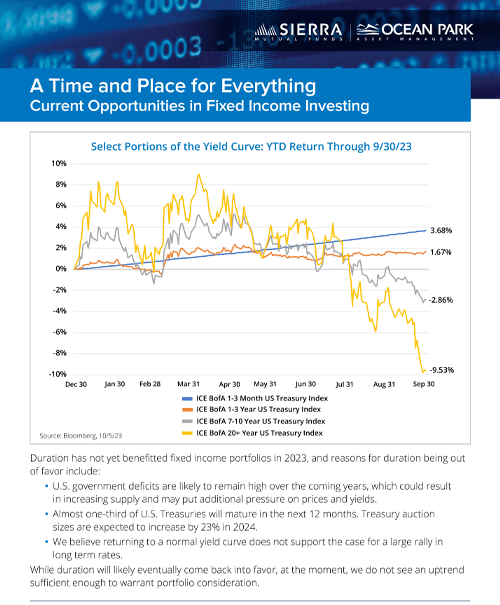

A Time and A Place for Everything: Current Opportunities in Fixed Income Investing

Chief Investment Strategist Ryan Harder explains why duration has been out of favor in 2023 and compares fixed income indexes.

| Sierra Tactical Municipal Fund - Class A & C - Fact Sheet | Download |

|---|---|

| Sierra Tactical Municipal Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical All Asset Fund - Class A & C - Fact Sheet | Download |

| Sierra Tactical All Asset Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical Risk Spectrum 70 Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical Risk Spectrum 30 Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical Core Growth Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical Bond Fund - Class A & C - Fact Sheet | Download |

| Sierra Tactical Bond Fund - Instl Class - Fact Sheet | Download |

| Sierra Tactical Core Income Fund - Class A & C - Fact Sheet | Download |

A Comprehensive Product Offering

A one page view of our comprehensive product offering for financial advisors.

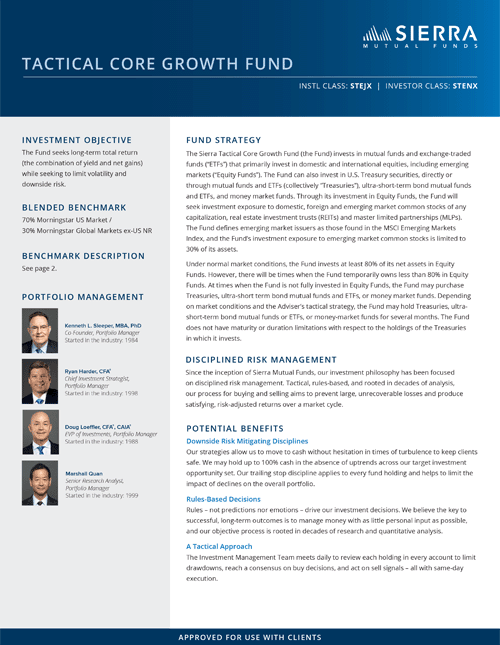

Tactical Core Growth Fund Fact Sheet

The Fund seeks long-term total return (the combination of yield and net gains) while seeking to limit volatility and downside risks.

Sierra Tactical Bond Fund Brochure

An overview of the Sierra Tactical Bond Fund.

Sierra Tactical Risk Spectrum Fund Series

Sierra's Tactical Risk Spectrum Fund Series is a suite of multi-asset funds targeting three distinct investor risk profiles.

Navigate Through Our Solutions

An all-in-one brochure that covers our core beliefs, investment process, funds, and strategies.

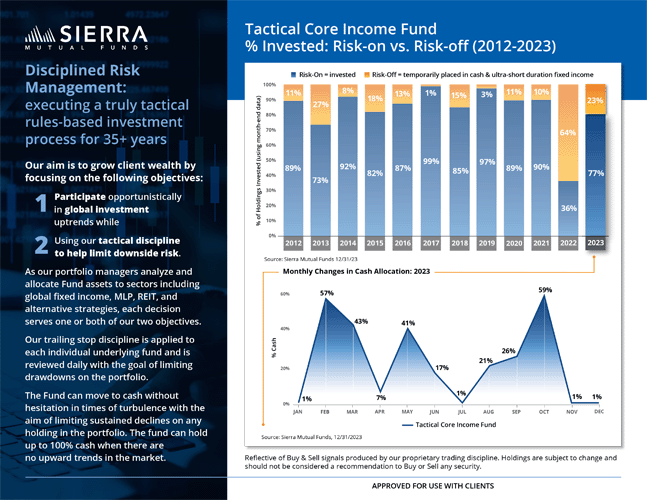

Tactical Core Income Fund: Risk-on vs. Risk-off

A snapshot of the "risk-on" versus "risk-off" holdings for the Sierra Tactical Core Income Fund, 2012 -2023, as well as the changes in the fund's cash allocation throughout 2023.

Sierra Tactical Risk Spectrum 70 Fund Profile Sheet

The two investment objectives of the Sierra Tactical Risk Spectrum 70 Fund are to provide total investment return and to limit volatility and downside risk.

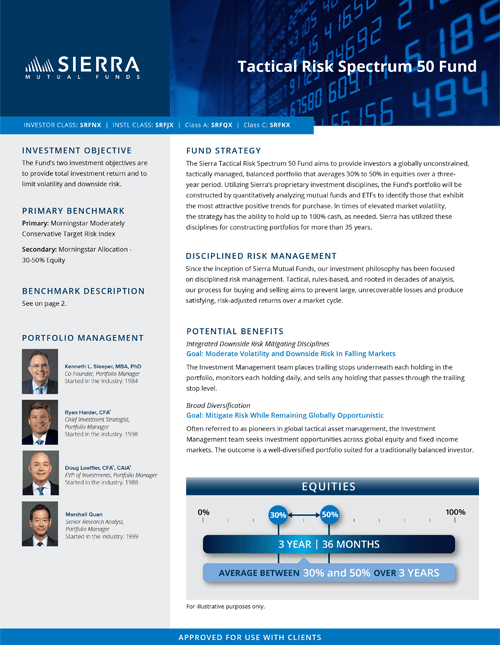

Sierra Tactical Risk Spectrum 50 Fund Profile Sheet

The two investment objectives of the Sierra Tactical Risk Spectrum 50 Fund are to provide total investment return and to limit volatility and downside risk.

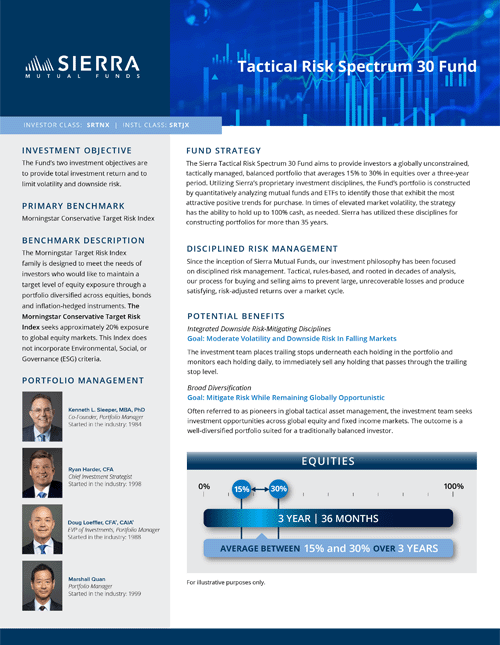

Sierra Tactical Risk Spectrum 30 Fund Profile Sheet

The two investment objectives of the Sierra Tactical Risk Spectrum 30 Fund are to provide total investment return and to limit volatility and downside risk.

| ROTH Individual Retirement Account (IRA) Custodial Agreement & Disclosure Statement | Download |

|---|---|

| Individual Retirement Account (IRA) Custodial Agreement & Disclosure Statement | Download |

| Coverdell ESA Custodial Account Agreement & Disclosure Statement | Download |

| Beneficiary Individual Retirement Account (IRA) Custodial Agreement & Disclosure Statement | Download |

| Beneficiary ROTH Individual Retirement Account (IRA) Custodial Agreement & Disclosure Statement | Download |

| Coverdell Education Savings Account (ESA) Application | Download |

| Non-Qualified Transfer of Assets Form | Download |

| Individual Retirement Account (IRA) Transfer of Assets Form | Download |

| Simple Individual Retirement Account (IRA) Custodial Account Adoption Agreement | Download |

| Individual Retirement Account (IRA) Custodial Account Adoption Agreement | Download |

CIO Insights - June 14, 2024

In June’s CIO Insights, James St. Aubin unpacks recent economic reports and the Fed’s June meeting in relation to the markets.

CIO Insights - March 29, 2024

In this short video, CIO James St. Aubin gives a quick recap of Q1 2024 economic and market forces.

CIO Insights: February 29, 2024

In this February 29, 2024 edition of CIO Insights, James St. Aubin discusses how consumers could control the fate of the economy, for better or worse.

The Founders' Series, Episode 5 | Grassroots Growth: Windshields, Seminars, and Stamps

The Founders' Series, Episode 5 | Grassroots Growth: Windshields, Seminars, and Stamps

CIO Insights: February 5, 2024

CIO James St. Aubin recaps data from last week’s Fed meeting, discusses why January’s payroll report prompts a need for easing policy caution, and why S&P downgrades are not holding true this earnings season.

CIO Insights: December 15, 2023

In this edition of CIO Insights recorded on December 15, 2023, James St. Aubin discusses a a significant week for financial markets - perhaps one of the most significant of the year.

CIO Insights: December 1, 2023

CIO James St. Aubin highlights November as a banner month for bonds and draws attention to the Bloomberg US Aggregate Bond Index – up 4.5% in total return last month.

CIO Insights - September 14, 2023

In this edition of CIO Insights, James St. Aubin touches on energy prices, the upcoming FOMC meeting, and what's potentially in store for interest rates.

CIO Insights - August 18, 2023

In this edition of CIO Insights, James St. Aubin touches on surprisingly strong US economic data and encouraging news on inflation.