Client-Ready Material

Disciplined Risk Management: Our Investment Process

Nov 09, 2023

Our Process

Sierra Mutual Funds participates in global uptrends, focuses on depth and diversity in the security selection process, and sells according to a Trailing Stop Discipline. When a decline in the markets meets our already-determined sell signals, we move swiftly to reallocate our portfolios, and we sell quickly, without emotion, speculation, or market pontification. Importantly, in the absence of uptrends, our products have the flexibility to quickly and temporarily move to cash allocations— up to 100%.

We believe our process, outlined below, sets us apart.

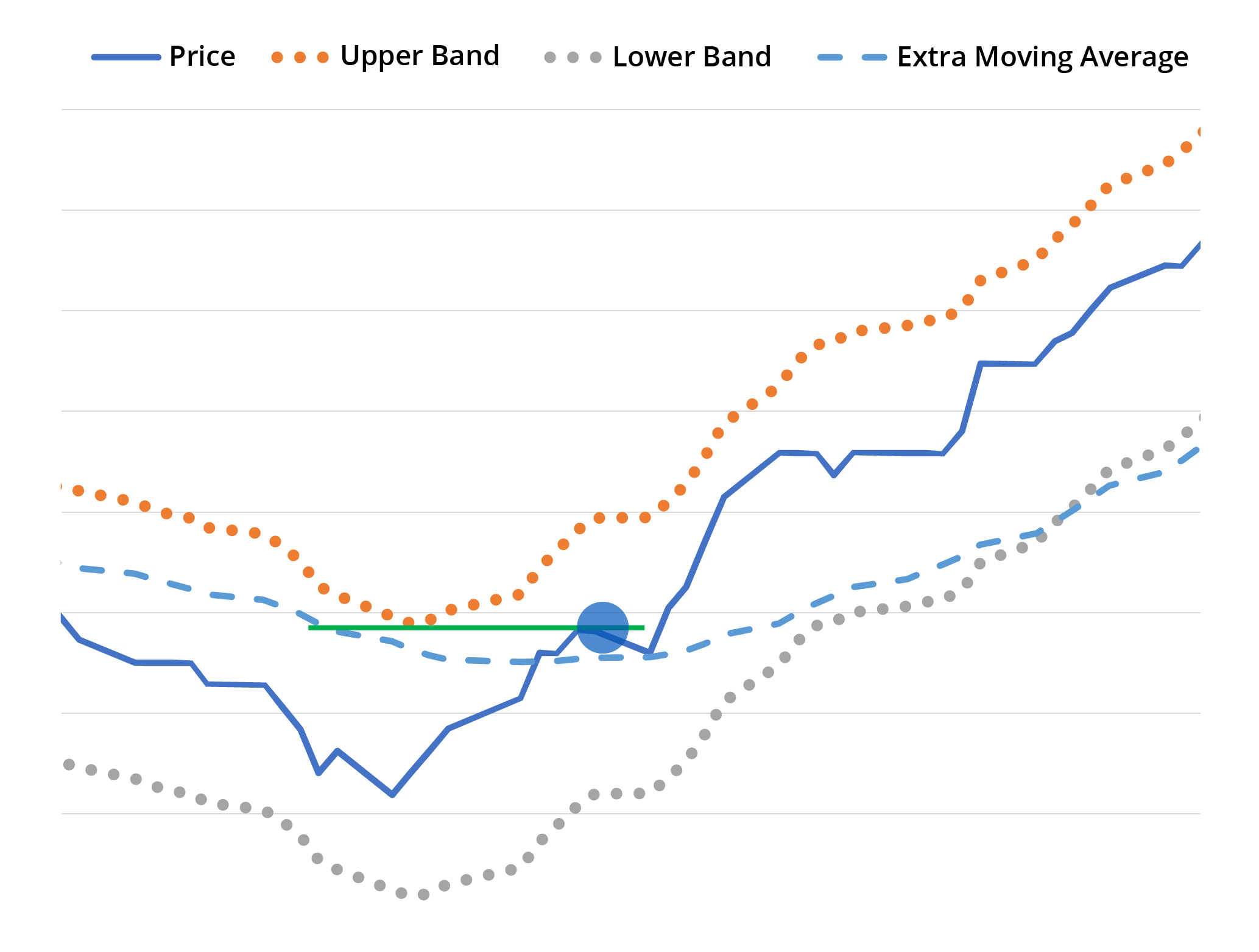

This is an illustrative example of how the Sierra Mutual Funds (“Funds”) and Ocean Park Asset Management, Inc. (“Ocean Park”) apply their buy-trend methodology to define buy levels/signals for potential security holdings. This is not a representative example of any particular security or client portfolio and is provided for educational purposes only.

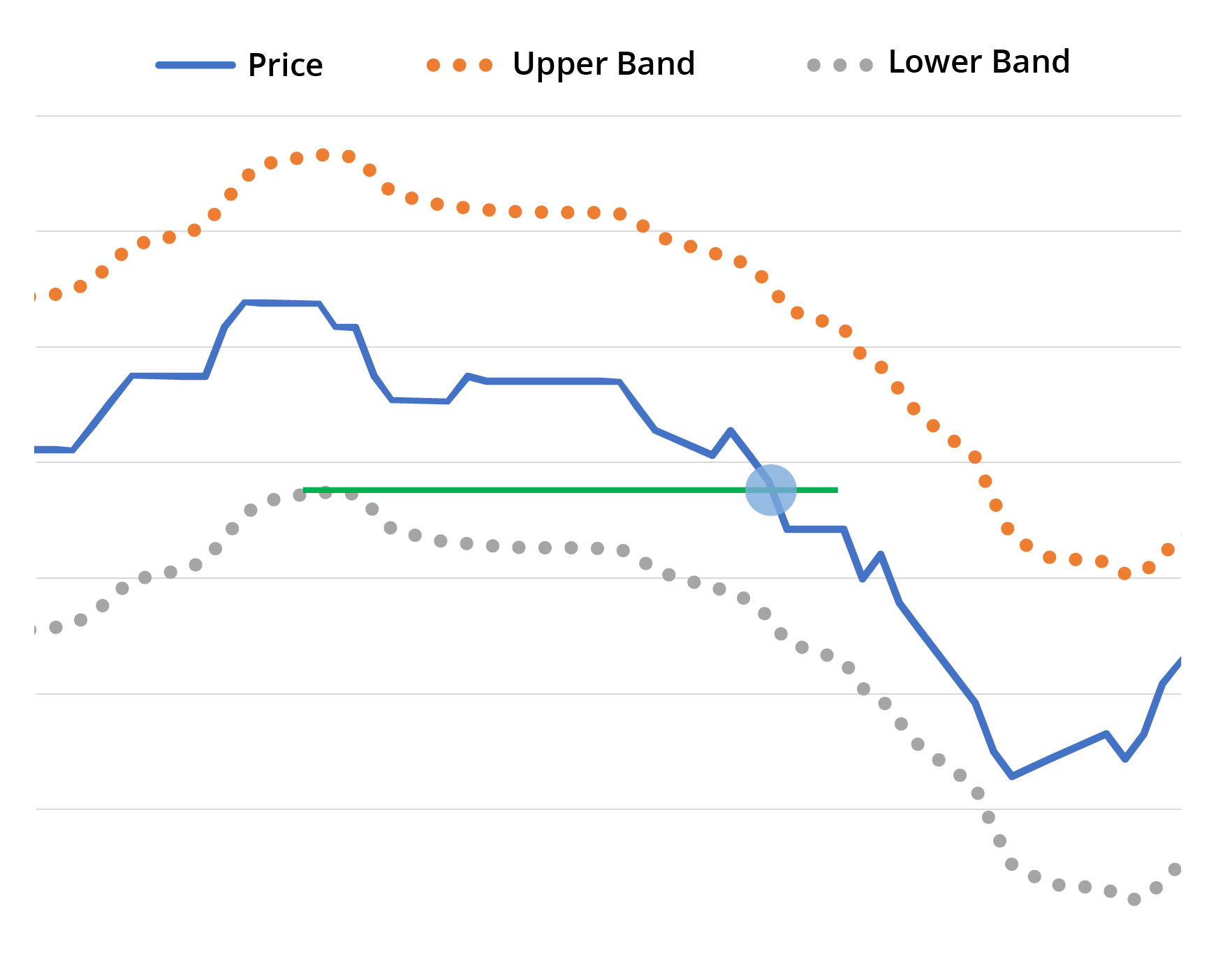

This is an illustrative example of how the Sierra Mutual Funds (“Funds”) and Ocean Park Asset Management, Inc. (“Ocean Park”) apply their trailing stop discipline (“Discipline”) to define sell levels/signals for security holdings in decline. This is not a representative example of any actual or particular security or any actual client portfolio and is provided for educational purposes only. The Funds and Ocean Park’s proprietary Discipline is used to support our disciplined risk management process. The Funds utilize this Discipline directly in the management of all underlying Fund holdings. Ocean Park utilizes this Discipline directly in the management of non-affiliated holdings. Where Ocean Park invests in its affiliated Sierra Mutual Funds, this Discipline is applied at the underlying funds level, not on the Funds themselves. The Funds are managed by Ocean Park Asset Management, LLC.

Exponential Moving Averages

Our quantitatively-based investment disciplines only invest when an uptrend has been established. We use exponential moving averages to help drive our decisions. An exponential moving average is a type of moving average that places a greater weight and significance on the most recent data points, and therefore, reacts more significantly to recent price changes compared to a simple moving average.Custom Bands

We create custom upper and lower bands for each eligible fund to help us identify when to buy or sell. The widths of the bands are related to the historic volatility of each fund and are set such that we would not anticipate more than two round trips per year. And we apply this rules-based discipline separately to each fund, rather than having a generic asset class-based signal.Resources